Volatility Index (VIX/VXO)

Implied volatility on options (VIX) is often used as a contrary indicator. If markets sell off and fear is high, the volatility index shoots up and may indicate a market turning point. Market tops are characterized by low volatility.

.

.

.

.

Investing/Trading Strategies

Description

Technical Analysis Based

Profitable stock trades can be made based on historical stock price information:

- Support and resistance levels

- Moving averages

- Chart patterns

- Momentum metrics

- Standard deviations

- Trading volume

- and so on

Fundamental Analysis Based

Profitable stock investments can be made using valuation metrics:

- Stock Price to Earnings

- Stock Price to Sales

- Book Value

- Debt to Equity

- and so on ...

Investor Psychology Based

Trading based on investor psychology:

- Usually a contrarian approach

- Emotions are more important than fundamentals or even technicals

- Ex: CNN Fear & Greed Index

Seasonality Based

Stocks and commodity prices are influenced by seasonal factors:

- Demand for gold during festival or wedding season

- Sell in May and Go-away for US Stock markets

- Window dressing by mutual funds

Efficient Market Hypothesis

Markets are efficient:

- All the information is instantly disseminated

- Past has no affect on future

- Stock prices are random

Stock TA

Symbol:

Analysis Chart RTQ Fibs News Opinion Profile

Analysis Chart RTQ Fibs News Opinion Profile

Presidential Year Seasonality

-

Mid-term Year (e.g., 2010)

- Q1: -0.1%

- Q2: -0.2%

- Q3: +3.0%

- Q4: +8.0%

-

Pre-election Year (e.g., 2011)

- Q1: +5.5%

- Q2: +5.0%

- Q3: +2.4%

- Q4: +2.6%

-

Election Year (e.g., 2012)

- Q1: +1.8%

- Q2: +1.6%

- Q3: +1.8%

- Q4: +2.0%

-

Post-election Year (e.g., 2013)

- Q1: -1.0%

- Q2: +1.0%

- Q3: +2.2%

- Q4: +2.0%

See Source

Sentiment Surveys

- Investment Advisors Survey by Investors Intelligence

- AAII individual investor survey

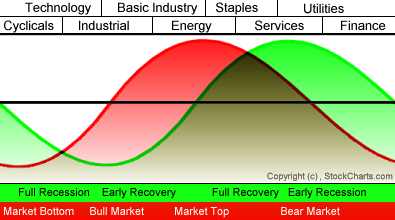

Economic Cycle Based

Buy & Hold

- Over long term stocks always go up.

- Indexes beat active investing (John Bogles approach)

Dollar Cost Averaging (DCA)

Buy at regular intervals (diversification over time). See calculation of returns with DCA.

Japanese Stock Market Performance

Over 25 Years

Over 25 Years

Insider Buying & Selling

Other Cycles Based

US Stock Performance Over 12 Years

S&P500 returned almost 0% over 12 years from 1999 - 2011.

Share Buy Backs

Contrary to common sense, companies seem to step up share repurchase programs when prices are high!

Other

- Sustainable growth & economic moats (Warren Buffets approach)

- Thematic investing based on mega trends

Resources

- Market Model from VectorGrader combines valuation, momentum, interest rates, etc.

- Market Rotation Model

Monthly Seasonality

Description